Today, with it costing you an arm and a leg to get by, cash back credit cards provide an excellent and easy method in getting rewarded when you spend your everyday spending. The right card will make your online shopping even more profitable, as you may get a percentage of money back being spent on each of the purchases online, the flight tickets, or your morning coffee. A large number of options can certainly be confusing, thus, how will you get the best cashback credit cards UK 2025?

We will explain how cashback works, and outline the best down to the smallest detail so you can become the owner of a suitable card that will fit your lifestyle in this extensive guide. In case you are in the UK, USA or Canada and want to maximize your savings just keep on reading because the steps and comparisons will be clear and you will be better positioned to make a very important decision.

What Are Cashback Credit Cards?

The best cashback credit cards UK 2025 reimburse you with a small portion of the amount you use to purchase goods. Think of it as getting a discount every time you spend. Cashback is simple and straightforward—it’s real money returned to you, unlike complicated reward points or air miles.

How Does It Work?

- Spend Money: You may use your card on a daily basis in grocery shops, gas stations or online shopping.

- Cashback: This is usually at a range of between 0.25 and 5 per cent depending on the card, and category.

- Redeem Cashback: Your cashback is normally added to your account as statement credit or to a bank account.

The main reason why cashback cards are popular in the UK, USA and Canada is that instead of having elaborate reward schemes, the cards turn everyday purchases into savings.

Top 5 Best Cashback Credit Cards UK 2025

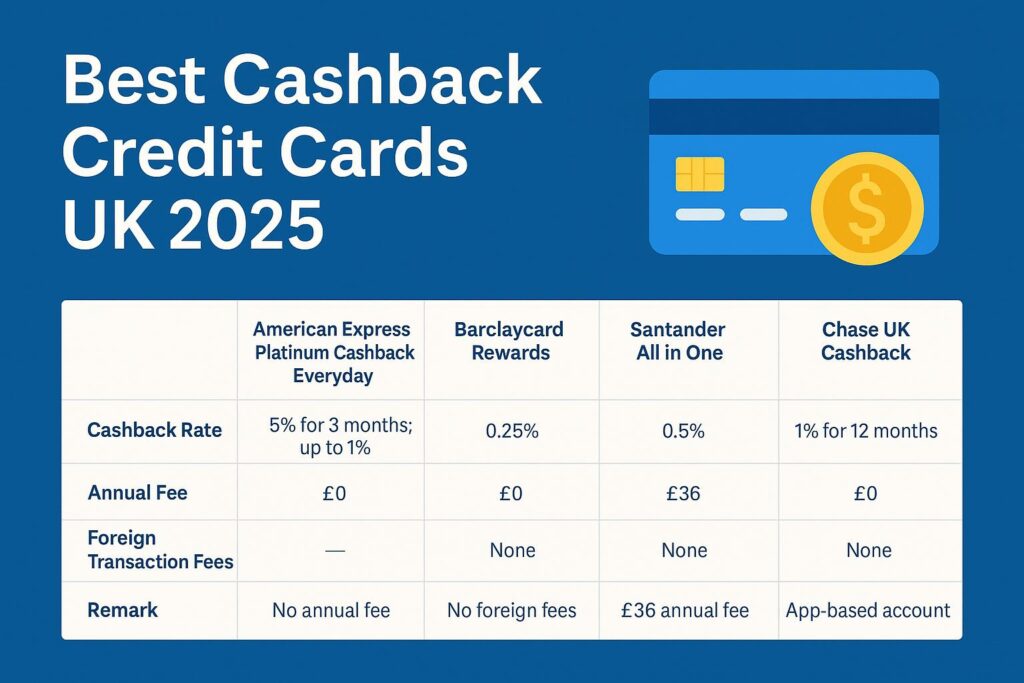

Here’s a detailed look at the best cashback credit cards in the UK for 2025. We’ve included cards that offer value for global users and UK residents.

American Express Platinum Cashback Everyday

Best For: Everyday shoppers who want a no-fee cashback card.

Key Features:

- 5% cashback on purchases for the first 3 months (up to £125)

- After the intro period, up to 1% cashback based on annual spend

- No annual fee

- Cashback paid once a year

- Worldwide acceptance via Amex network

Pros:

- High initial cashback rate

- No fees to worry about

- Trusted brand

Cons:

- Amex isn’t accepted everywhere in the UK

- Annual cashback payout, not monthly

Example Use Case:

If you spend £500 per month, you could earn £125 cashback in the first 3 months.

Barclaycard Rewards Card

Best For: Travellers and people who spend abroad.

Key Features:

- 0.25% cashback on all purchases

- No foreign transaction fees

- Excellent exchange rates

- Mastercard network (widely accepted)

Pros:

- Great for international spending (ideal for US/Canada users visiting the UK)

- Cashback on everything, no categories to track

- No annual fee

Cons:

- Lower cashback rate compared to others

Example Use Case:

Use it for travel expenses without worrying about currency conversion fees.

Santander All in One Credit Card

Best For: People who spend regularly and prefer simple rewards.

Key Features:

- 0.5% cashback on all purchases

- No categories or spending caps

- £3 monthly fee

- No foreign transaction fees

Pros:

- Straightforward cashback

- Great for international purchases

Cons:

- Monthly fee reduces net cashback if you don’t spend enough

Example Use Case:

If you spend £1,000 monthly, you’d earn £5 cashback—enough to cover the fee and still profit.

Chase UK Cashback Credit Card

Best For: Digital-first users who love mobile banking.

Key Features:

- 1% cashback on all everyday spending for the first 12 months

- Managed via the Chase app

- No fees or hidden charges

- Cashback is instant and can be used right away

Pros:

- High cashback rate for the first year

- Instant cashback

- Fully managed online

Cons:

- App-only account; no physical branches

- Offer drops after 12 months

Example Use Case:

Perfect for tech-savvy users who want to manage everything via smartphone.

NatWest Reward Credit Card

Best For: Existing NatWest customers or those who shop with partner retailers.

Key Features:

- 1% cashback at selected retailers (e.g., supermarkets, fuel stations)

- 0.25% cashback on all other spending

- £24 annual fee

Pros:

- Higher cashback at partner stores

- Simple redemption through the NatWest app

Cons:

- Cashback categories are limited

- Annual fee applies

Example Use Case:

If you regularly shop at partner retailers, this card can be very rewarding.

How to Choose the Right Cashback Card

Selecting the best cashback credit card depends on your lifestyle. Here are some tips:

| Consideration | Why It Matters |

| Spending Habits | Some cards reward groceries; others travel. |

| Acceptance | Amex vs Mastercard/Visa acceptance varies. |

| Fees | Watch for annual or monthly charges. |

| Cashback Caps | Some cards limit how much you can earn. |

| International Use | Pick cards with no foreign transaction fees for travel. |

Pros and Cons of Cashback Credit Cards

Pros

- Earn While You Spend: Get money back for everyday purchases.

- Simple to Use: No points to track or complicated rewards systems.

- Extra Perks: Some cards offer travel insurance or purchase protection.

Cons

- Fees Can Offset Rewards: Be mindful of monthly or annual fees.

- Debt Risk: Interest charges will cancel out cashback if you don’t pay in full.

- Acceptance Issues: Some cards like Amex aren’t accepted everywhere.

Conclusion

With its cashback credit cards, it can be your vehicle to having your money work hard, but only in a prudent way. The finest cashback credit cards UK 2025 will show the most fantastic deals to both the UK residents and prime users in the USA and Canada. If it is a no-frills card, high interest rates, or global benefits you are after, a card is available.

Suppose you learned something valuable in this guide, tell your friends, save your bookmarks, or comment below. By your interest we are able to reach more people and provide them with valuable information!

FAQs

Which is the best cashback credit card in the UK 2025?

The introductory cashback is highest on the American Express Platinum Cashback Everyday card, which charges no yearly fee, and, therefore, it makes it one of the most desirable in 2025.

Are cashback credit cards reasonable?

Sure–cashback cards can make good sense as a means of saving a few bucks on every-day purchases–provided, of course, that you are going to pay off your balance every month.

Are UK cashback credit cards accepted in countries overseas?

Other cards such as Barclaycard rewards and Santander All in One do not charge foreign purchases so they are great cards to use abroad.

Do cashback cards impact my credit score?

As with all credit cards, the proper usage will give you a better credit score. Delinquent payment or high balances will damage it.

What is the process of spending cashback?

Other cards automatically credit your account and others allow you to deposit cashback to your bank, or get credit towards a statement.